- #W9 free fillable forms 2016 how to

- #W9 free fillable forms 2016 update

- #W9 free fillable forms 2016 software

- #W9 free fillable forms 2016 code

- #W9 free fillable forms 2016 zip

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Emerald Cash Rewards™ are credited on a monthly basis. H&R Block is a registered trademark of HRB Innovations, Inc. All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Additional terms and restrictions apply See Free In-person Audit Support for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state). W-9 tax form questionsĭo you have additional questions about IRS Form W-9 or need help filing your return? Our tax pros speak the tricky language of taxes and are committed to helping you better understand your return. In the post, you’ll find information about requesting W-9s for business vendors and contractors.

Need to complete a W-9 for your business? Check out this information on Form W-9 for businesses. You can view the current W-9 on the IRS website.

While some tax forms update from year to year, the W-9 2020 has not changed from previous tax years. W-9 2020 – Is the form different than previous years?

Entities that are exempt from FATCA reporting requirements enter the appropriate code found in the instructions section. Entities that are exempted from backup withholding should enter the appropriate code found in the Instructions section.

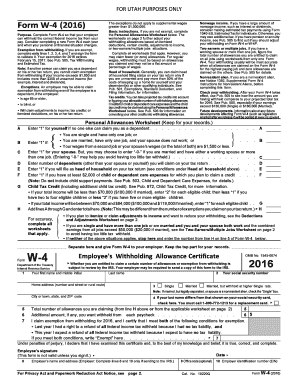

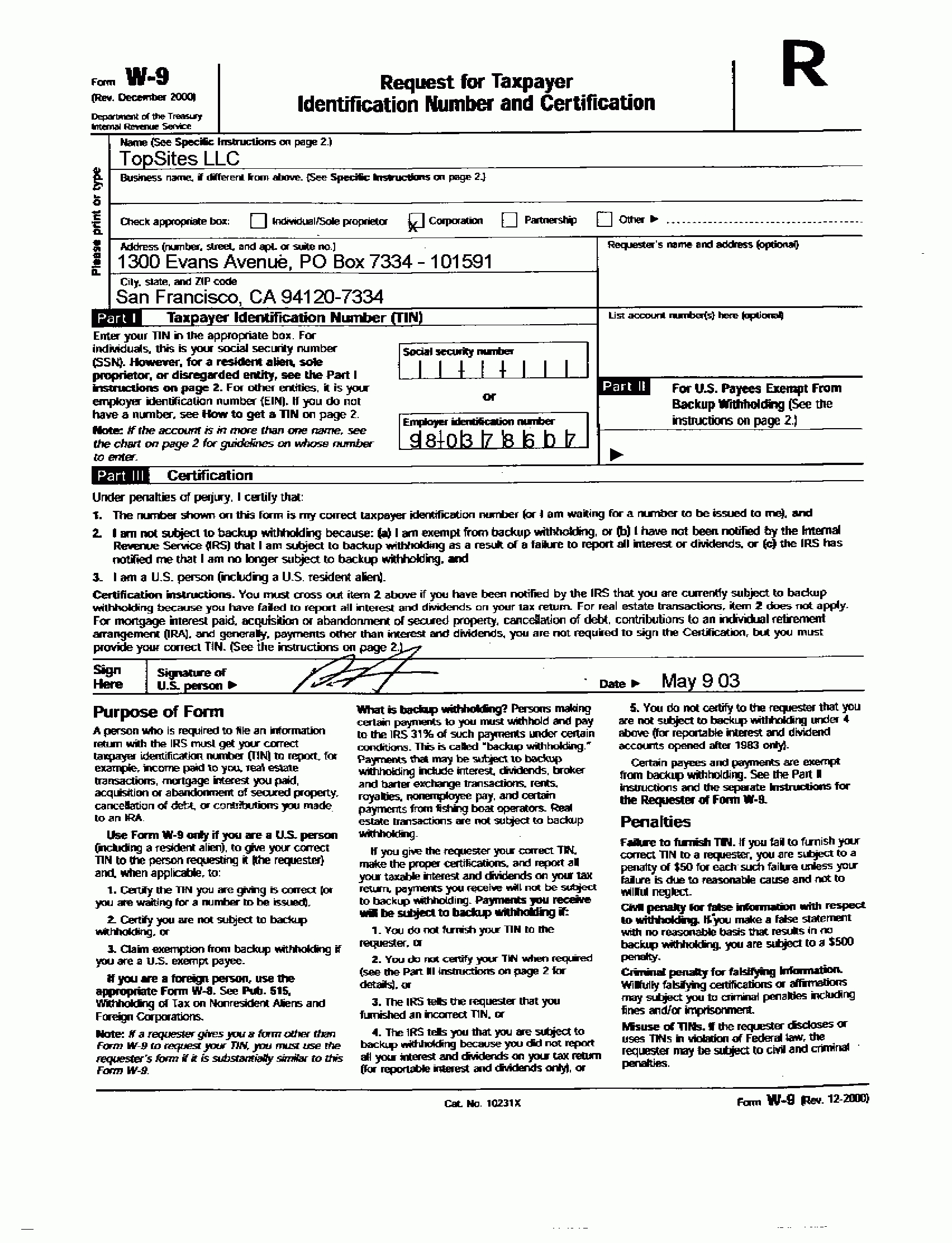

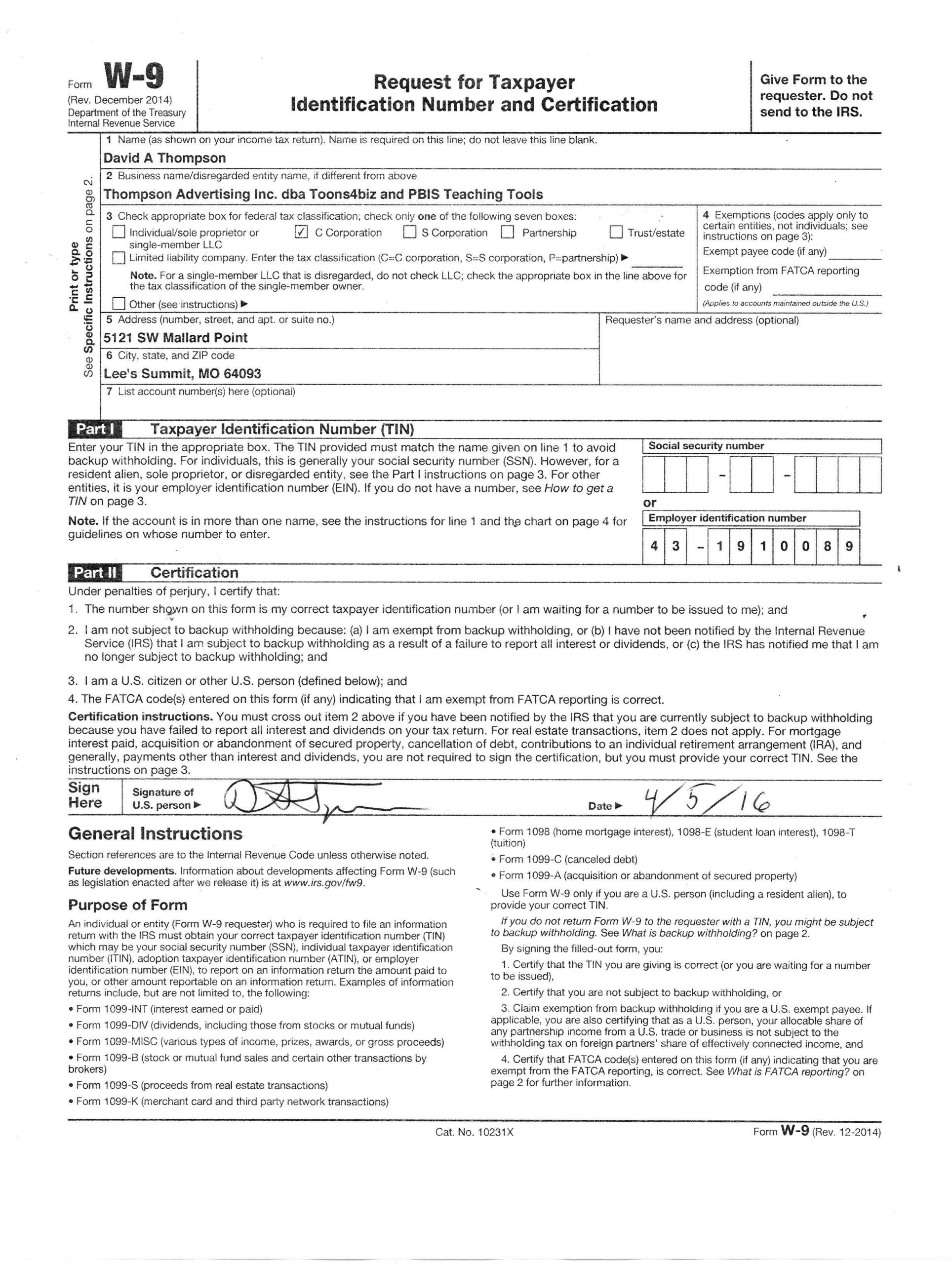

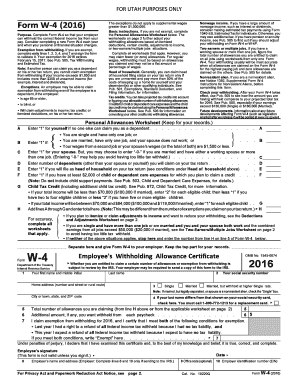

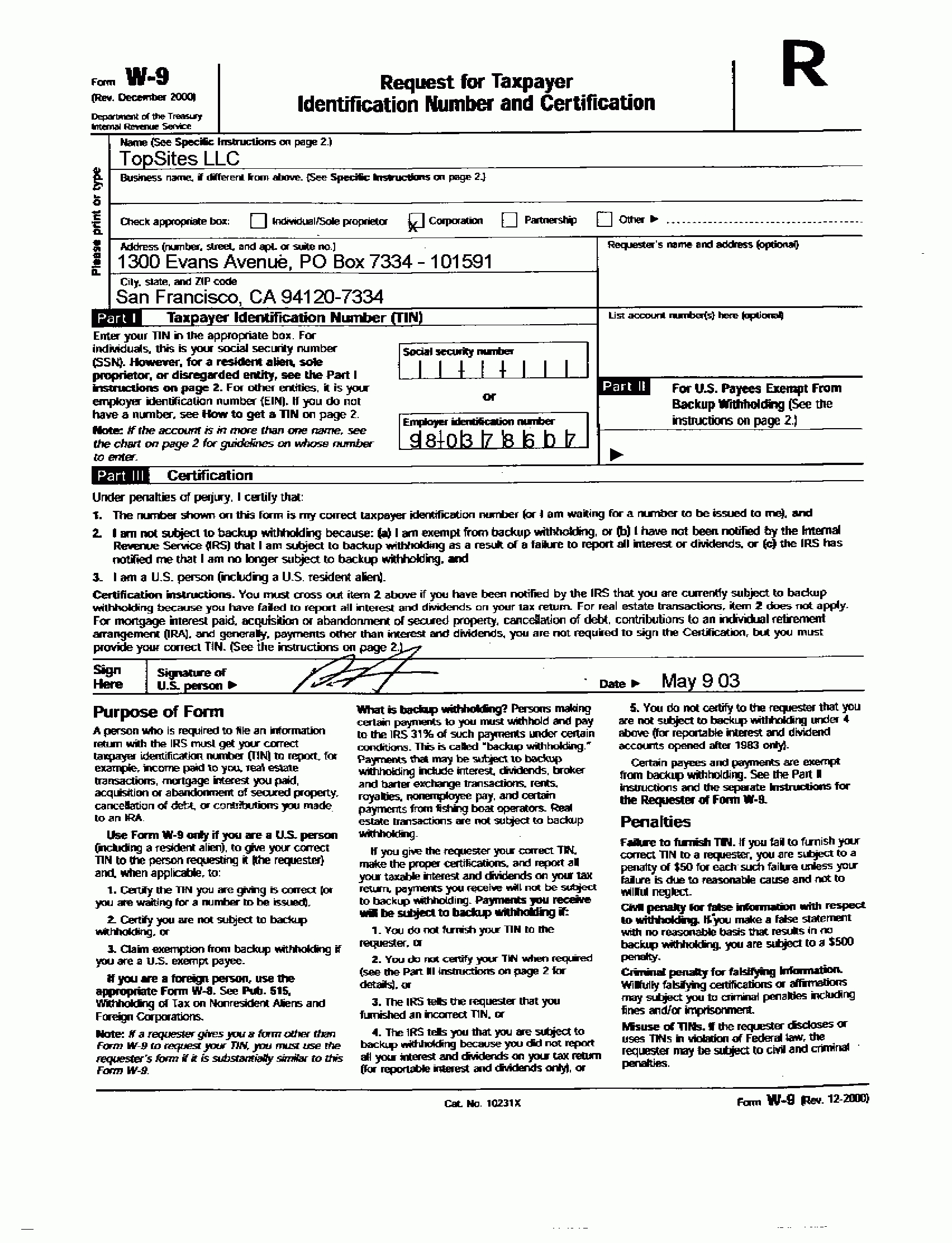

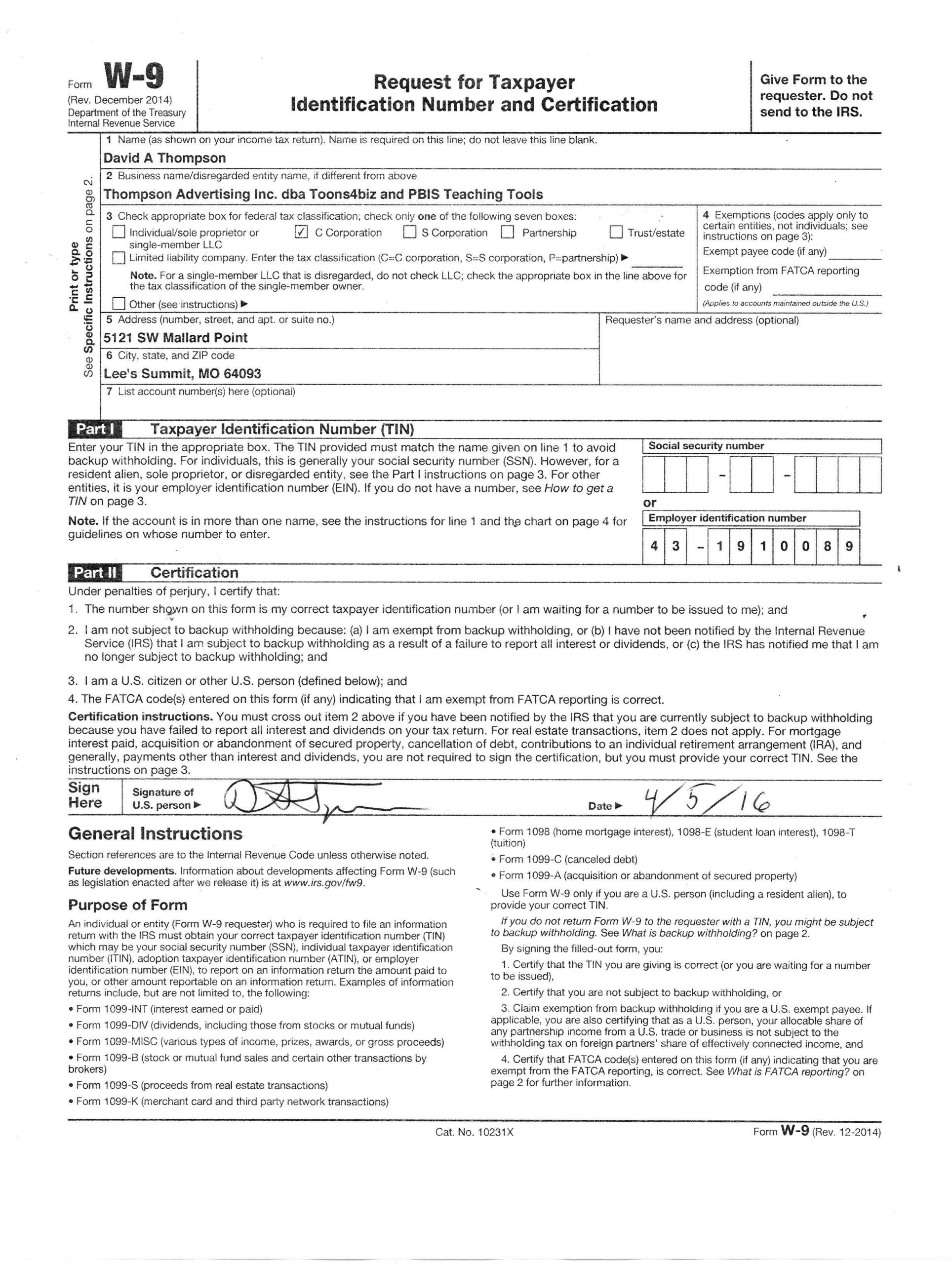

Exemptions – This section of the W-9 tax Form applies only to certain entities, not to individuals. If a taxpayer fails to certify their TIN and backup withholding status on IRS W-9, or similar statement, backup withholding may begin immediately. Backup withholding may apply when a taxpayer has not met TIN certification requirements or if they previously didn’t report income correctly to the IRS. Backup withholding – This is a percentage of income that is held from the taxpayer’s payments received and is remitted to the IRS. Business entities will complete the form using their Employer Identification Number (EIN). Taxpayer Identification Number (TIN) –For individuals, this is generally your Social Security number (SSN), but it can be an Individual Taxpayer Identification number (ITIN) if you don’t have an SSN. Review the list below for explanations to a few common terms found on this form. If you’re required to complete an IRS W-9 Form, you may come across terminology with which you are not familiar.

Write the business’ city, state, and zip code.Įnter the Social Security number or Employer Identification number. Write the business’ address (number, street and apartment number or suite number). Include any exemption codes, if applicable. Fill out the federal tax classification for the person whose name is entered on line 1. Write the business name/disregarded entity name if different than above. Write the name as shown on your income tax return.

Write the business’ city, state, and zip code.Įnter the Social Security number or Employer Identification number. Write the business’ address (number, street and apartment number or suite number). Include any exemption codes, if applicable. Fill out the federal tax classification for the person whose name is entered on line 1. Write the business name/disregarded entity name if different than above. Write the name as shown on your income tax return. See how to fill out a W-9 in these steps. The good news here is that filling out a W-9 is a fairly short form. When you hear that you need to fill out a W-9, you might think it will be a complicated tax form. Stock and mutual fund sales and broker transactions.Contributions the taxpayer made to an IRA.Acquisition or abandonment of secured property.While tax form W-9 is used most commonly by independent contractors, gig workers, and freelancers who are paid $600 or more by a business, it can also be used to report other types of income to the IRS.

0 kommentar(er)

0 kommentar(er)